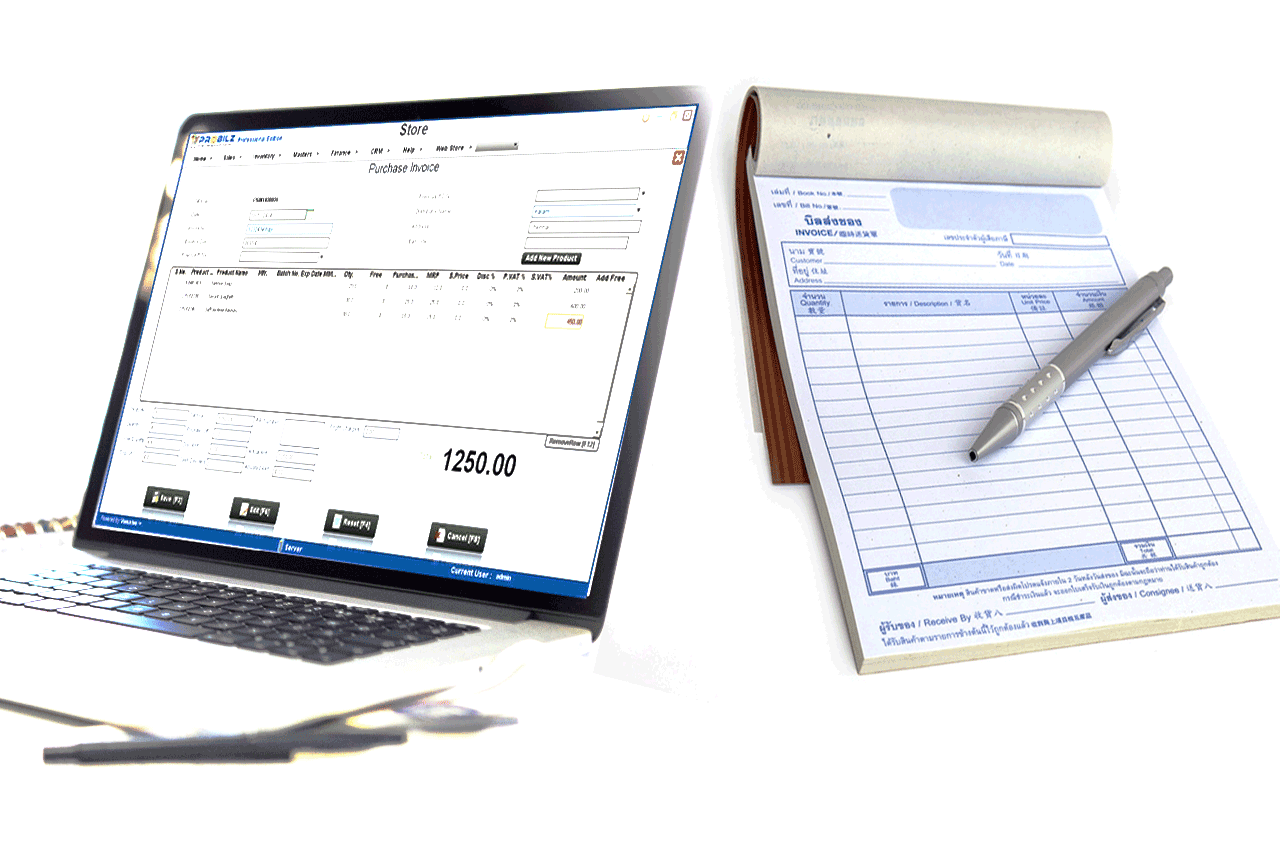

Why is computerized billing much better than paper billing?

Published Feb 17, 2020 By Nitya Nagaut

In today’s age and times, the digital world has become the norm, in pretty much every aspect of our lives. A large chunk of what we do every day is “computerized”, so to say. Especially the current generation is eventually moving towards an era where perhaps paper billing will be reduced to a redundant concept, such as the grasp of technology! The digital payment framework makes it extremely easy and quick to view bank balances and pay bills online through computers, smartphones, and tablet devices. The following are some of the reasons why electronic Hitech Billing Software

system should replace paper billing:a. Saving the trees: Paperless bills are environment-friendly, which means lesser trees will be cut for paper, eventually leading to reduced air pollution from paper production. Some credit card issuers have also promised to make their contributions to ecological causes when you opt for paperless hitech billing software system.

b. Less mail and paper in your home: With the growing elimination of billing statements, your home will have far lesser clutter. You can also save time which is usually spent in going through paper bills and sorting them out in terms of which ones are to be kept, which ones are to go to the trash can, and which others must be shredded. On the other hand, by downloading your billing statements, you can save them to your computer or external drive. They are accessible whenever required.

c. Perks for online billing statements: Often you will find credit card issuers offering incentives to cardholders who sign up for paperless statements. Additionally, some card issuers charge a fee to send a paper statement and waive this fee when you sign up to receive your billing statement online.

d. Identity theft prevention: Stolen mail can lead to identity theft, which has highly risky consequences. This can be prevented by switching to paperless statements since they are not mailed in hard copy to your home. Even if someone manages to hack into your email account, he cannot access your credit card information since one needs to log into your credit card issuer’s website to view your statement.

e. Automation: Since all the calculations are taken care of by the free accounting software, automated billing does away with many of the tedious and time-consuming processes associated with manual accounting.

Several vendors have, in today’s times, implemented robust marketing strategies aimed at encouraging customers to pay bills via online banking. It is a much better idea to access the company's website to make a payment electronically or even set up a recurring ACH payment than to send cheques via mail. However, despite such measures, some people still prefer to receive statements in the mail. One potential reason for the same may be for address proof. Many institutions such as schools, government organizations, and service providers still do not accept printed electronic statements as proof of address, which in turn acts as a hindrance to the large-scale acceptance of electric bill statements.

Most businesses place utmost emphasis on customer satisfaction. Although one cannot enforce bill presentation and payment service for free, studies have revealed that this service is ranked highly in customer satisfaction surveys, so it is advisable for businesses to come up with ways which will merely the payment process for customers. However, it has also come to light that was just offering a free invoicing software will hardly suffice when it comes to bringing about complete electric system. Few years down the line, businesses will need to make conscious effort may be in the form of attractive incentives so that customers are encouraged to switch over to electric bills completely.

As far as cost and operation are concerned, businesses would be most benefitted if customers follow through with 100% computerized bills. Making the bill payments absolutely computerized will ensure that there is a minimum need for paper statements, thereby saving money, resources, as well as the environment. Some companies design their payment procedures in such a way so that when customers opt to make electronic payments, they can also receive their statements in a computerized manner, then and there. In recent times, it is quite evident that customers are preferring the freedom and convenience of automated bills, but whether they will fully adapt to it, to the extent of discarding paper bills entirely, is yet to be seen.

Some reports also indicate that from 2010 to 2015, the number of consumers who receive both a paper and a digital statement has also remained steady. Further, nearly 1 in 4 financial institutions customers and bill payers still choose to get online as well as paper statements each month. These “double dippers” basically want to pay their bills online rather than respond with a mailed payment, but at the same time, they also do not want to leave the convenience and reminder of a paper bill. The reason why customers are increasingly resorting to computerized bills but also not choosing to receive their bills only by electronic means is two-fold:

1. Consumers want the hard copy of invoices and statements for their records, and also as a reminder that their bills are due.

2. The digital experience in current times is not very user-friendly- customers need to remember several user IDs and passwords and use websites with different navigations and document retention timelines.

Studies and analyses suggest that there is an apparent disconnect between senders and recipients. Companies should make it extremely easy for consumers to go paperless, and also reward them enough to drive them towards computerized billing. The marketing strategy needs to go through significant changes to induce further adoption of paperless transactions; it is simply not enough to only cite environmental benefits and “clutter reduction” as the key advantage of computerized billing software system.

This is a business-centric problem with a business-oriented solution- one that should go beyond the “going green” aspect of paperless billing. This may include:

1. Making computerized billing the default option for new or double dipping customers,

2. Updating policies to charge a service fee for paper-based bills;

3. Providing the opportunity to consolidate the company's paper or computerized bills under a single provider, be it a bank or any other source;

4. Offering loyalty points along with other incentives, and ensuring an improved experience for customers who opt for computerized bills systems.

The need of the hour is that companies should provide more options to deliver an enhanced digital experience across all the communications they send to customers, which should not just be limited to bills and statements. It is also essential to promote the expansion of secure electronic document delivery, which will facilitate customers to quickly receive their sensitive documents encrypted from the company directly from their inbox.

Here’s taking a more detailed look at why paper billing in outdated in today’s digitally driven world:

Enhanced security: Paper bills require businesses to print and mail sensitive information to customers. This information makes its rounds through several postal service departments before the customer can lay his hands on them. Being such a lengthy procedure, it is vulnerable to errors- the paper bills might get lost, delivered to the wrong person, and so on. Computerized statements, on the other hand, does not need any middleman and aids direct communication of personal information between the business and the consumer. This lessens the risk of loss statements and mail fraud. Computerized mails also facilitate consistency, since business statements are sent at the same time every month without having to involve a third party. Besides, customers can archive and retrieve such bills more comfortably and securely.

Reduced costs: By switching to computerized bills, businesses can save money, time, and other resources. Previously a whole team was in charge of printing, folding, and mailing paper statements every month. Especially concerning large businesses with massive billing operations, paperless billing can contribute immensely to cut down costs. Additionally, paper bills not only need paper but also have to rely on a constant supply of other printing materials, postage, and manual effort, which are, in turn, capital intensive.

Furthermore, businesses with paper billing need to have arrangements and correspondence with a postal or shipping service. Electronic billing system is not dependent on these recurring expenses.

Accelerated operations and payments: it can be quite a tedious administrative function to send paper statements via mail. Not only are plenty of hours invested in it, but sufficient employees are to handle the departments of printing, packaging, stamping, and so on. By switching to computerized billing, businesses can streamline the entire process and allows employees to focus on more important tasks, that can make a difference to the company. Also, in the case of paper statements, it may so happen that weeks pass by before the customer opens the bill. On the other hand, email is instant and is thus likely to reduce the length of time between the business' request for payment and the actual receipt of funds.

It is high time both businesses and customers break away from traditional paper bills, and turn to the electronic billing software system thereby not only reduce the environmental impact, but also ensure economy in terms of time and money, besides, of course, enjoying several other benefits.

Make your first invoice today — It’s free!

To Download GST software online visit www.freebillingsoftware.com